Nothing halts a conversation faster than mentioning the “b-word,” — budget. It happens all of the time and while money talk can be uncomfortable, when it comes to planning your marketing and branding strategy, it is critical to know what you can spend.

Some of your internal thoughts may be….

“I don’t want an agency to overcharge me.”

“An agency should tell ME what my budget should be.”

“Can we just talk about services and tactics first, and then pricing for that?”

While all of these are reasonable questions to ask yourself, what’s not reasonable is trying to form a partnership and strategy without a concrete idea of what you can spend. So, let’s look at a couple of different ways you can nail down your marketing budget numbers.

How to calculate your marketing budget

Most recommendations follow that new companies should spend 15-20% of their gross revenue on marketing and established companies should spend between 8 – 12% of their gross revenue on marketing. For some of you–that’s all you need to know! Those stats will carry you with confidence into your next budgeting session and you can go forth from there.

HOWEVER, the rest of you might need a little bit more than a couple of stats to help you figure out your marketing budget. The good news is that it’s not as hard as you may think to figure it all out. We have a few simple and a few math-y ways for you to help.

FIRST: the math-y way to determine your marketing budget

Here are a few equations you can use to help you on your path to figuring out your marketing budget:

Calculate the average lifetime value of a customer.

Knowing the lifetime value of your customer helps you figure out how and why you should be spending marketing dollars. The customer lifetime value, or LTV, tells you how much in revenue each customer can generate with your company. The longer a customer stays with you, the higher their LTV.

In order to calculate an LTV, a little bit of information and math *is* required, but the legwork will pay off when it comes time to create your marketing budget and fill in your lead pipelines!

LTV equation: We like HubSpot’s LTV formula because it helps break the process up in an easily digestible way–which in turn makes it easier for you to explain to stakeholders who may not have your level of expertise!

Step 1: Average purchase value.

Your company’s total revenue of time period / number of purchases in that time period.

Step 2: Average purchase frequency rate.

Number of purchases over a time period (usually a year) / # of unique customers in the same time period

Step 3: Customer value

Average purchase value – Purchase frequence rate

Step 4: Average customer lifespan

The average number of years your customer purchases with your company.

Step 5: Lifetime value

Customer value x average customer lifespan.

Ok, but how do you use this number to help determine your marketing budget? By knowing the average lifetime value of your customer, you’ll understand how much they’ll be spending with you which can help you determine if your cost per lead is too high or too low.

“Cost per lead? “ You say. Cost Per lead is the next (less math-y) math we’re going to do.

Calculate your cost per lead.

Your cost per lead is how many advertising dollars it takes for a lead to materialize. The equation is really simple (and only one step this time!):

Your cost per lead (CPL) is a simple equation:

total advertising dollars / number of leads

So, if you’re currently spending $5,000 a month on advertising and got 10 new leads from that advertising, your current cost per lead is $500. Compare your cost per lead to your customer LVT– if your CPL is higher than your LVT then you need to change tactics as that’s not scalable OR profitable.

Now, think about that stat from the beginning: Most recommendations follow that new companies should spend 15-20% of their gross revenue on marketing and established companies should spend between 8 – 12% of their gross revenue on marketing.

SO, think about that %, your cost per lead (for your current marketing tactics) and your customer lifetime value. Can you connect the dots?

SECOND: The NON-mathy way the determine your marketing budget

Hi, hello! If you’ve scrolled right on past the math-y way to get to this part–there is no shame. I applaud your time-management! While there are many Envisionaries that are all about those numbers, we realize that having a handy-dandy tool to provide a little extra help and clarity would be a useful thing!

Enter: the Envision Creative Lead Generation Calculator. This easy (and free) tool can help you figure out how many new customers you need each month to get to your desired revenue. It takes some of the math from the previous section and turns it into a scale.

What the lead generating calculator helps you do is tool around to figure out how much website traffic and how many leads you need a month in order to get your desired number of new customers/new revenue each month.

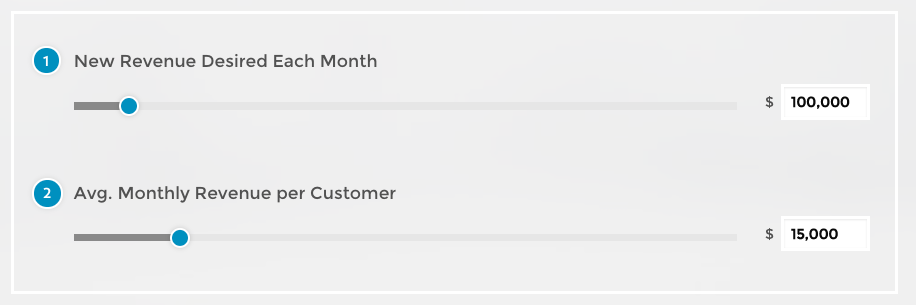

Think about how much revenue you’d like to get each month and how much your average monthly revenue per customer is.

If you’ve calculated your CLVT by the period of a year–divide it by 12, if a quarter, divide by 3–you get the point. If you didn’t do your CLVT because you don’t want to or don’t know–you can either take a calculated guess or ask your finance department for some billing numbers averages to help you get a better idea.

Once you’ve set your scale our calculator will give you your first stat: how many new customers you’ll need each month to achieve your goals:

In our example, if you want to make $100k a month in new revenue, and your average monthly revenue per customer is about $15k, then you’ll need at least 6 – 7 new customers a month to achieve your goals.

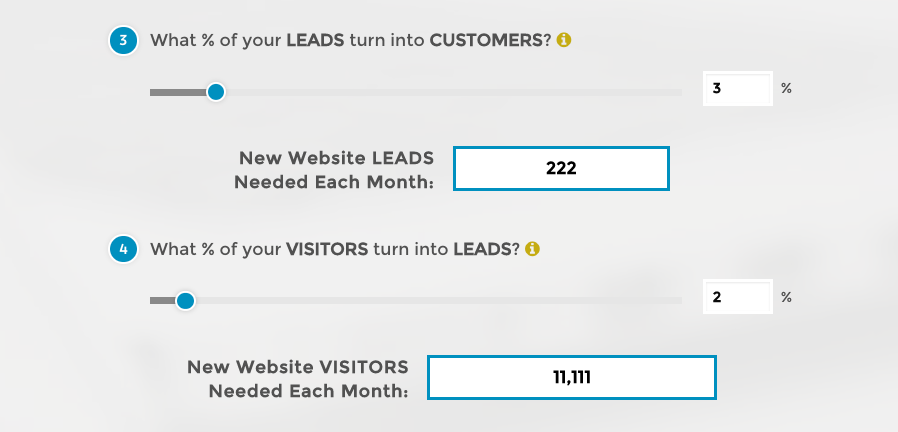

But that doesn’t mean you need 6-7 new leads (unless you’re closing rate is 100% and if it is, why are you reading this!?!) hence part 2 of the calculation:

Input the % of your leads that turn into customers (re: how many of the leads to your site actually convert?), and then how many of your visitors turn into leads–it’s kind of backtracking but it’s to make the process easier.

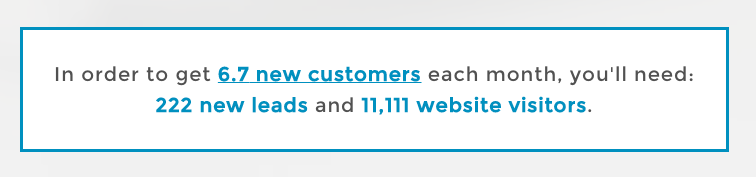

In this example, the conversion rate from lead to customer is 3% and the number of website visitors that turn into leads is 2%. Know that you need to make $100k a month in new revenue and your average customer monthly revenue is $15k– you now know you’ll need to send at least 11,000 new people to your site a month.

The grand finale?

Based on your conversions rates you now know how much traffic you need to get to your site to get the number of customers you need in order to make the revenue you’ve set. If you’re making $100k a month in new revenue, our data tells us that you’ll want to spend a minimum of $96,000/year on your marketing spend (that’s 8%). Keep in mind that 1. This is just an example with made-up numbers and 2. This number is only based on your NEW revenue per month, not your total so your overall marketing budget should take that into account.

Marketing budgets can be exhausting

If you don’t need a nap after this post then kudos to you! I need a nap after writing it. BUT, here are the main takeaways for this post:

- In order to come up with a legitimate marketing budget, you need to know how much you make and how much you WANT to make.

- Knowing your cost per lead and your customer lifetime values can be critical components in figuring out if your current marketing budget is actually helping you pay the bills.

Still not sure what to do? We’re here to help. Budget conversations can be less than fun but they need to happen if you want a realistic and successful marketing strategy.

-FINAL(01-00)-White&Blue-01.svg)